Following the 2023 Autumn Budget, the information presented below may no longer be accurate.

In the November 2022 Autumn Statement, the Chancellor announced significant changes to the current Research & Development (R&D) tax reliefs. The key announcements were a change to the applicable rate of the Research and Development Expenditure Credit (RDEC) and a dramatic change to how SME (small and medium-sized enterprises) R&D tax credits are calculated, taking effect for expenditure incurred on or after 1 April 2023.

The changes announced by Jeremy Hunt in the Autumn Statement are in addition to the previously planned changes announced in July 2022. This article discusses the forthcoming changes to the RDEC and SME scheme, and will hopefully serve as a useful guide to companies who will be wondering what all this means for their financial forecasting and cash runway.

Reduction in benefit to the SME

The SME scheme applicable to SME companies, historically considered generous, has been affected massively. Not only will the rate of the enhanced tax deduction based on qualifying R&D expenditure reduce from 130% to 86%, the payable tax credit will also reduce from 14.5% to 10%. These two changes in combination will have a significant impact on how much cash companies can claim. Under the current legislation, an SME can surrender an enhanced loss in the year, up to 230% of the qualifying expenditure included in the claim, for a payable credit equal to 14.5% of the surrendered loss. This means that companies are currently able to claim roughly 33.33% of their qualifying expenditure (i.e. 14.5% of 230%).

Following the change in rates, the enhancement rate will drop to 86%; meaning that companies will only be able to surrender losses equal to 186% of qualifying expenditure. Combined with the reduction in payable credit rate, the new blended rate will be equivalent to just 18.6% of qualifying expenditure.

The changes announced in the Autumn Statement will apply to expenditure incurred after 1 April 2023, rather than affecting accounting periods beginning on or after the same date. For most companies this will result in a split year treatment; some costs will be claimable under the current rates with expenditure later in the period being claimed under the new lower rates.

It is important to note that it is not mandatory to surrender enhanced losses. Claimant companies are entitled to retain the enhanced loss and offset it against future taxable profit (if applicable). Historically, the difference between surrender or retention of the enhanced loss has been fairly nugatory and most companies have opted for the cash refund wherever possible. However, a combination of the scheduled increase in the main corporation tax rate to 25% from April 2023 together with the proposed reduction in the payable credit rate means that there will be a 15% difference in value. For some companies, it may now be better to hold on to the enhanced losses.

Increase in net tax benefit of RDEC scheme

The changes to the RDEC scheme are less dramatic, seeing a credit rate increase from 13% to 20%. This results in a change of net tax benefit value (taking into account the notional tax charge applied to the gross RDEC claim) from the current 10.5% to 15%.

Changes to both SME and RDEC schemes for accounting periods beginning on or after 1 April 2023

- There are certain conditions which would need to be fulfilled to make overseas unconnected subcontractor and unconnected externally provided worker costs as eligible.

- The government is intending to include data licence and cloud computing costs incurred directly for R&D in the scope of the qualifying expenditure.

- The definition of ‘field of science and technology’ has been broadened and will now include Mathematics as a field of science and technology. Previously Mathematics was not considered to be a field of science and technology and therefore the R&D projects focused on this field was not qualifying.

The first of the above changes is the more significant of the three. Historically, where R&D work has been subcontracted to a third party such as a CRO, 65% of the cost incurred has been claimable. This same 65% restriction will continue to apply, but subcontracted work conducted outside the UK will only qualify if there are geographical, environmental or social conditions or legal/regulatory requirements which make it necessary for the work to be conducted outside of the UK. These same conditions are applicable when considering whether the costs of overseas externally provided workers are claimable. In the absence of such conditions only expenditure on UK staff would be allowable.

The exact conditions that would render overseas expenditure claimable are still unclear. The draft legislation makes it plain that factors such as cost of the R&D and the availability of workers would not be considered relevant conditions.

Otherwise, the inclusion of data licences and cloud computing costs is welcome, as these costs grow more significant as the nature of how R&D is conducted evolves.

Increased scrutiny and administrative changes from 1 April 2023

To counter abuse of the R&D schemes, HMRC has developed new due diligence and filling processes, including:

- The claimant companies will have to pre-notify HMRC of their intention to make an R&D claim. This will be predominantly applicable to companies who will be making their first R&D tax claims. Crucially, this notification must be made to HRMC within 6 months of the end of the relevant period; so for a December year end, the deadline for notification would be June 30th. Companies who have submitted R&D tax credit claims in any of the three preceding periods will not need to make any notification.

- All claims will have to be submitted online, and there will be a requirement to provide a description of the R&D undertaken by the company; a breakdown of the qualifying expenditure and details of the advisory agent used as part of the submission. This will need to be endorsed by a named senior officer of the company.

Comparison of the R&D tax relief benefits under the previous and new changes

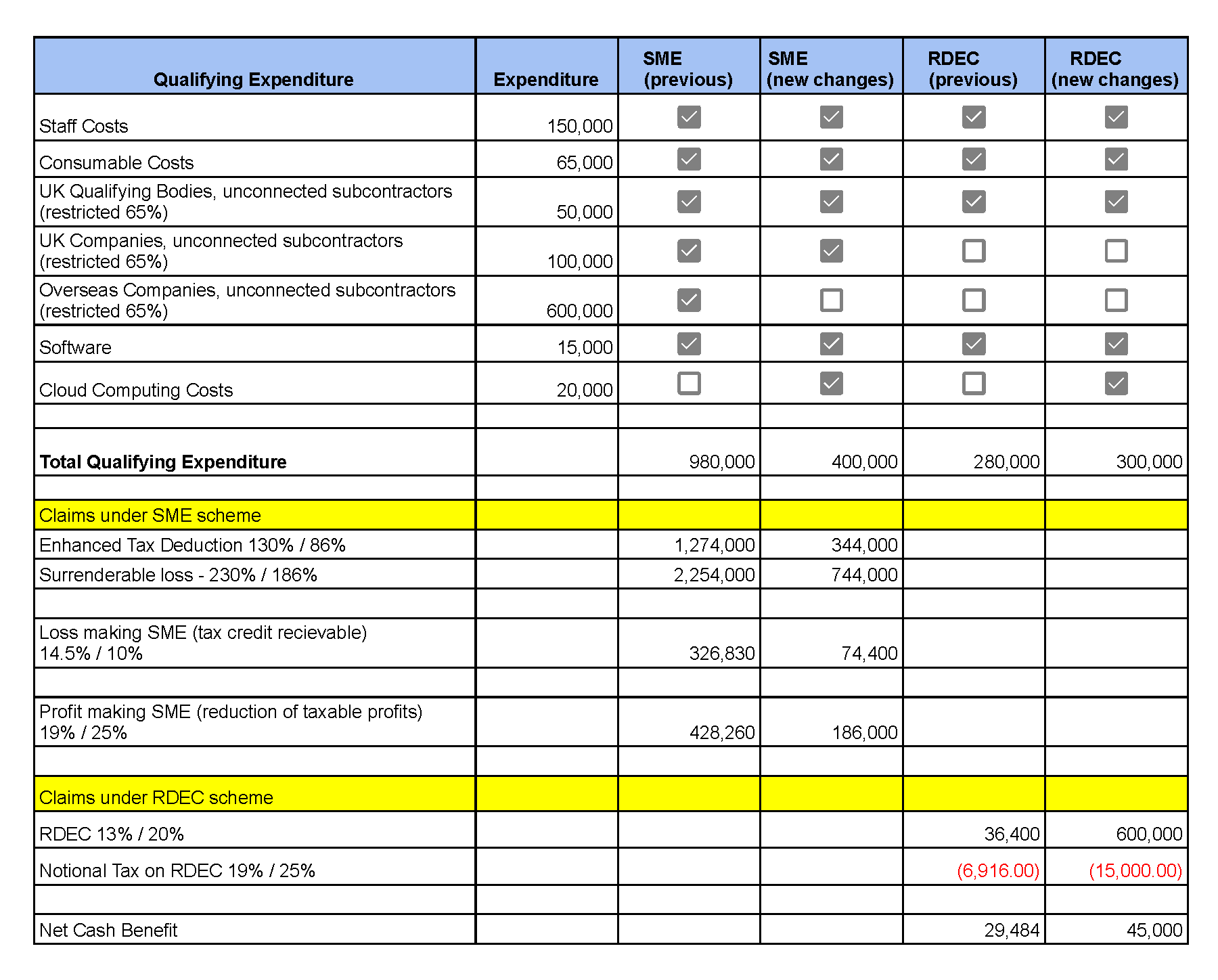

The table below shows a comparison of how the forthcoming changes will impact the amount of payable credit which can be claimed, under both the SME and RDEC regimes. Please note that the below is a simplified example.

Assumptions: accounting date of 31st March each year; the claimant company is not caught by the “lower of” rule; it can surrender the full loss in each case; they are exempt from the PAYE cap. For the RDEC columns, the assumption is that the company has incurred sufficient PAYE/NIC liability in the period to enjoy the full claim; it is not offsetting any corporation tax liability; it is therefore claiming the full cash benefit available. The RDEC calculation also assumes that the project claimable under RDEC represents subsidised expenditure, for example from an Innovate grant.

The table above shows stark differences between SME claims under the current regime and the new regime from April 2023. It’s clear that the introduction of cloud computing costs and similar will only make a significant difference to companies who are incurring a great deal of that sort of expenditure. The major change, as expected, is caused by the exclusion of external expenditure conducted overseas. We expect this to be the main concern for most of our clients, although even companies who are already spending predominantly in the UK will still see a reduction.

There is, however, an interesting quirk arising from the changes. If a company’s external expenditure on unconnected subcontractors or unconnected externally provided workers is already UK based and if that company wishes to retain all of the losses against future taxable profit rather than surrendering for cash, then that company will see an increase in overall benefit from these changes.

A change in approach?

In many ways, it is surprising to see the changes to the R&D reliefs introduced now. There were already wide-ranging measures due to take effect from April 2023, targeted at tackling abuse and a high level of fraudulent claims, with the obvious goal of reducing the amount that is paid out to invalid claimants. Perhaps it would have been sensible to wait and see if the new anti-fraud measures would be effective before deciding to slash the credit available to genuine claimants.

The concern now is how these changes will affect the knowledge economy in the UK overall. We know from discussions with our clients, and with other firms of advisors around the world, that the SME tax credit scheme was a major part of a package of tax measures that has had a significant track record of success in attracting top worldwide talent to the UK and making the UK one of the best places in the world for an R&D focused startup. It remains to be seen what the future will look like.

The 2022 Autumn Statement does seem to signal a change in approach by the Treasury. The previous set of proposals announced in July 2022 were mainly focused on rewarding UK spending and targeting abuse of the system. Those changes were announced following a long period of consultation, allowing industry bodies, taxpayers and advisors to give their feedback on how the changes would land. In contrast, last week’s shock announcement was made without any prior consultation. This is both a surprising and unwelcome development.

One positive take away from the Autumn Statement was that the government committed to increasing public spending on R&D to £20 billion a year by 2024/2025. This additional spending will be targeted at the Catapult programme, as well as increasing Innovate grant funding. Are we seeing a pivot from rewarding R&D through the tax system to subsidising R&D directly through grant funding, and indirectly through the Catapult programme?

Get involved

As part of the Autumn statement, the Chancellor announced that the government would consult on reconciliation of the two schemes into one unified scheme, and whether additional support would be needed for R&D intensive SMEs. Those reading this article may have already formed some strong views on the subject, and we would like to convey those views to the treasury on your behalf when the consultation opens.

More generally, within the team at Frazier & Deeter and Confluence Tax, we will be delighted to help you plan your future R&D claims and assess the impact the new changes have on your R&D claims.

For more information contact:

Malcolm Joy Malcolm.joy@frazierdeeter.com

Thomas Wells Thomas.Wells@frazierdeeter.com

Research and Development Tax Relief reform – GOV.UK (www.gov.uk)